November 20, 2023

How to Identify Cryptocurrency Traps? EagleEye Deciphers the Schemes

About EagleEye: https://eagleeye.space/

EagleEye is a Web3 B2C platform that allows users to analyze projects, addresses, risks, and relationships between projects. The platform can also help users monitor the projects and SmartMoney addresses they are interested in. EagleEye’s goal is to help Web3 users

Find α (alpha), Avoid Scam.

About the author: EagleEye community researcher — Alpha Hunter

Eaton (Twitter Handle: @EatonAshton2);

wenshuang (Twitter Handle: @shuang_log2pi);

In the world of cryptocurrency, the emergence of knockoff coins is not uncommon. These knockoffs often masquerade as hot market projects to lure investors and reap benefits. However, they usually lack solid technology or viable business models, aiming instead to deceive investors and embezzle funds.

Recently, leveraging the buzz around Elon Musk’s Grok xAI launch, a project named GROK skyrocketed in token price after its introduction on November 4th.

On November 13th, blockchain analyst ZachXBT tweeted allegations of fraud against the project, noting its Twitter account had been used by various scam ventures previously. This revelation caused the token’s value to plunge over 50%.

To identify and avoid such counterfeit coin traps, investors must remain vigilant and conduct thorough due diligence. Today, we will guide you on how to spot similar scams using the EagleEye platform, a part of Beosin, and analyze the fund flow of GROK token transactions using the Beosin KYT anti-money laundering platform.

How Does the GROK Knockoff Coin Attract Users to Participate?

1. Leveraging Hot Topics and Network Effects

Elon Musk, a renowned entrepreneur, garners media and social media attention with any project he introduces. The GROK project cleverly capitalized on Musk’s reputation and influence, associating itself with his ventures to attract more attention and investment.

Initially, GROK leveraged the AI concept and Musk’s recent Grok xAI launch to garner significant attention from crypto users on social media platforms.

The GROK team claimed their project was a “meme” initiative, leading people to believe that participating in its transactions would yield high returns. This promotional strategy ignited interest and speculative tendencies, leading people to trade impulsively without thorough research and analysis.

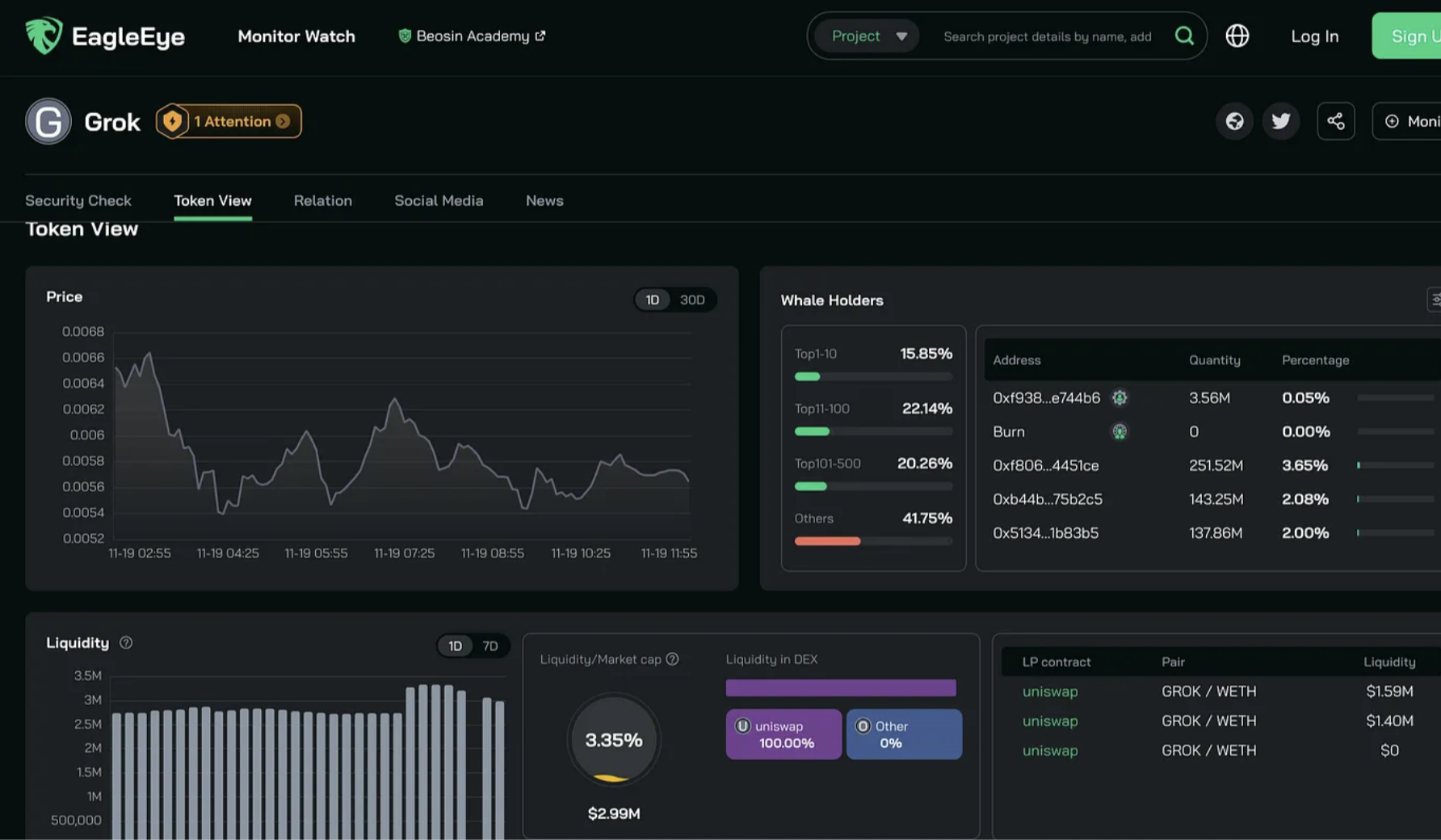

2. Low Liquidity Pumping Method

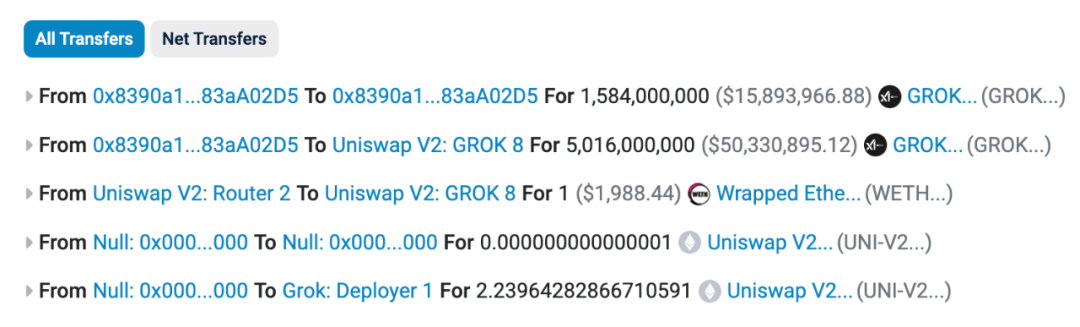

Upon scrutinizing the on-chain information of the GROK token deployer, it was discovered that the deployer initially deployed 5.016 billion GROK tokens and 1 ETH in the Uniswap V2 pool:

Shortly after the project's launch, multiple high-risk addresses made significant purchases of GROK tokens within the first minute.

Address 1:

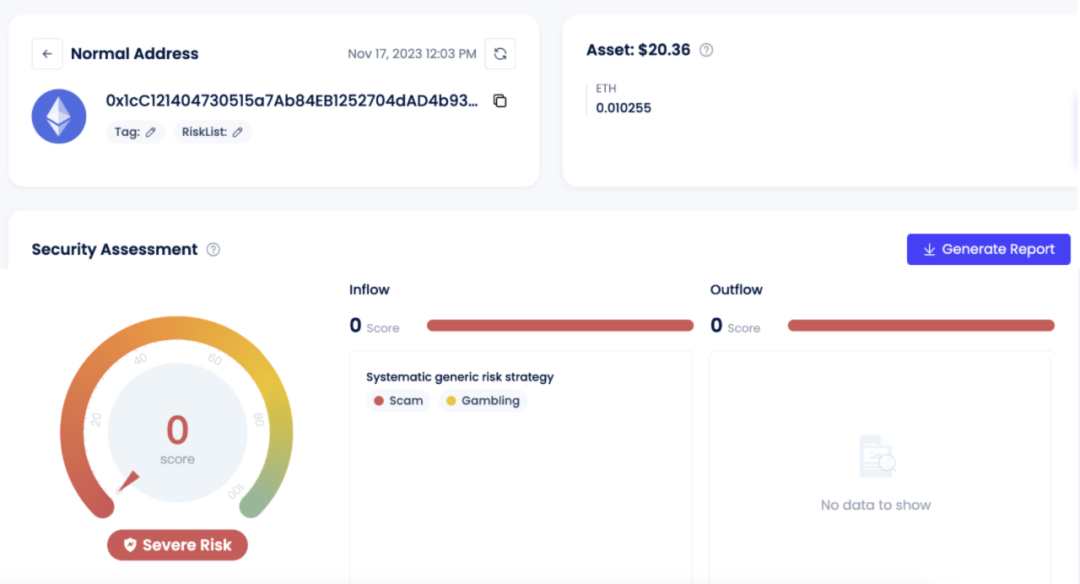

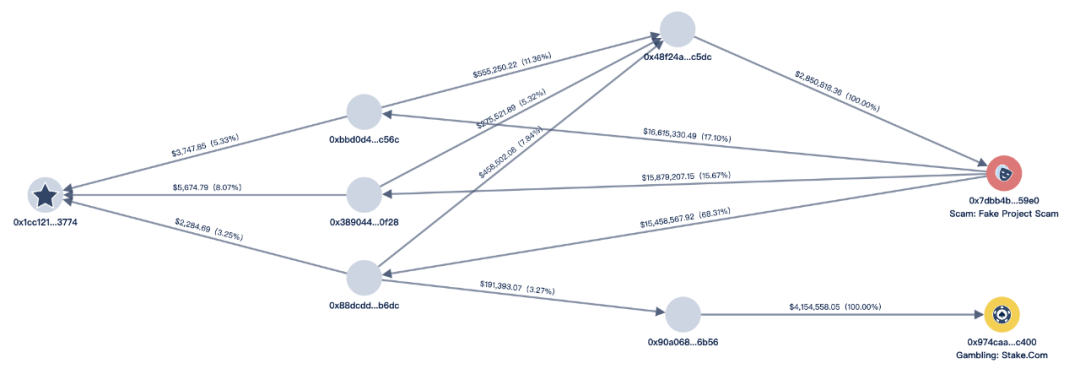

0x1cC121404730515a7Ab84EB1252704dAD4b93774

Transaction Hash: https://etherscan.io/tx/0x48d5d48f2c28dc4235eea30ecf8f0f2b0a2a723498438a5602294df64a2a47bf

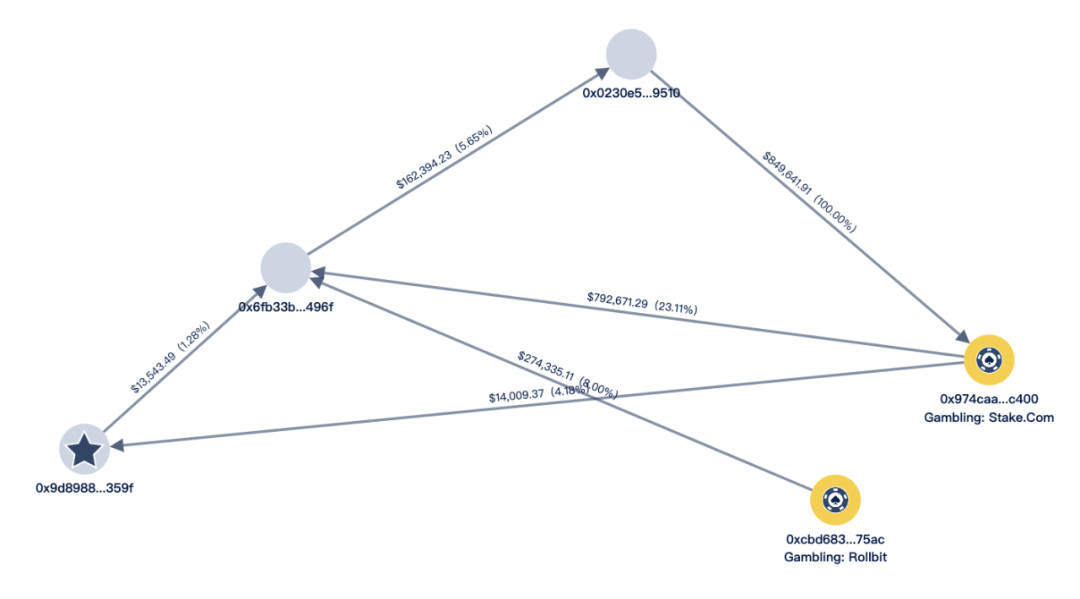

This address acquired 101,111,968 GROK tokens within 35 seconds of the launch, currently valued at $1,005,744. Analysis using the Beosin KYT anti-money laundering platform revealed that funds in this address originated from previous scam projects and gambling platforms, categorizing it as a high-risk address.

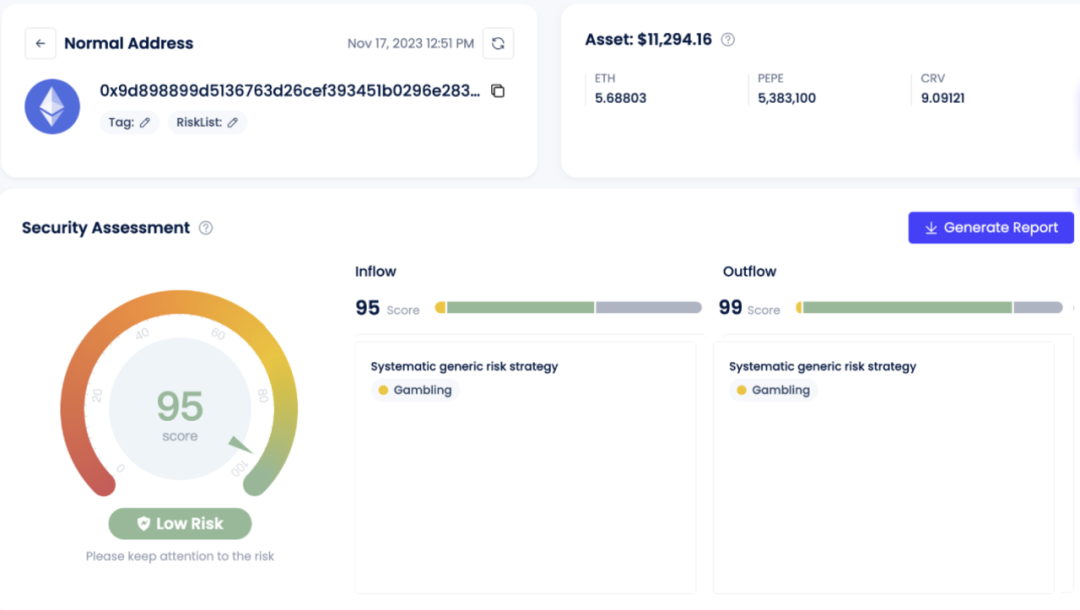

Address 2: 0x9d898899d5136763d26cef393451b0296e28359f

Transaction Hash: https://etherscan.io/tx/0xd31f599b65633982823c729a0920e47f3dde563abcc1aac9b961ff8e67ecb689

This address also purchased 138,000,000 GROK tokens within 35 seconds of the launch, currently valued at $1,371,173. The Beosin KYT anti-money laundering platform indicated that funds in this address originated from a gambling platform, involving significant fund transfers, categorizing it as a high-risk address.

Other high-risk addresses that made large purchases within 2 minutes of the GROK launch include:

- 0xa773520d856e640d12f9aa0cfcefe944a14bdead

- 0xd2d53711910812d71b35fc72a45f71a95e5522b8

- 0x6a9c69aa3b6c373945fb37e795c6a5fdd4fcbe54

- 0xd2d53711910812d71b35fc72a45f71a95e5522b8

These patterns of rapid, large-volume purchases by high-risk addresses shortly after market opening are typical indicators of potential fraudulent activity in cryptocurrency markets.

How Users Can Identify Scams

To avoid falling prey to knockoff scams, users and investors should exercise caution when selecting investment projects. It’s crucial to investigate the project’s background and development team, assess the risks and potential rewards, and evaluate the project’s security using reliable sources.

1. Investigate Project Relationships

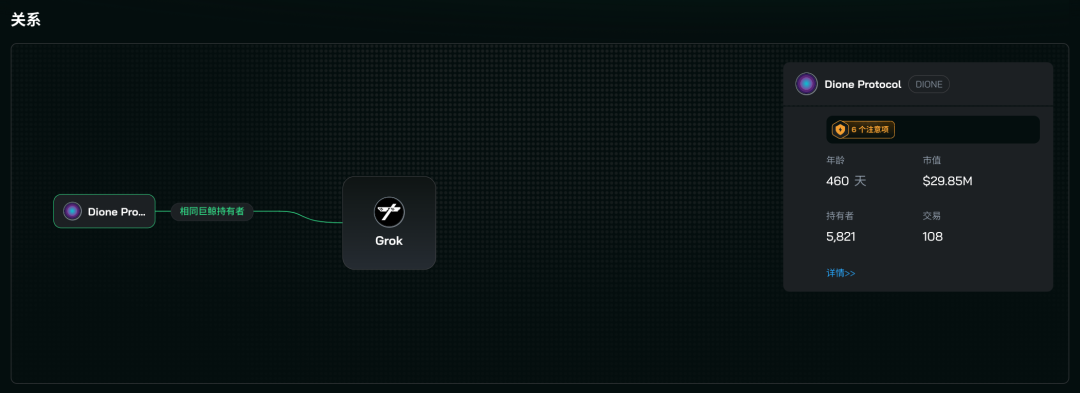

Taking GROK as an example, EagleEye can analyze project relationships, showing that GROK shares some of its major investors (‘whales’) with Dione Protocol, as illustrated below.

EagleEye Project Relationship for GROK: https://eagleeye.space/relation/grok

By examining the activities of one such whale (0x5ED639EB11D3936828bC2F615cBc46102225aC6b), we find that it has been accumulating GROK tokens since November 4th and currently holds over 1% of GROK tokens.

2. Assess Key Address Risks

Once users have identified relevant addresses through project relationships, they can use EagleEye to assess the risk associated with these addresses. Taking the aforementioned whale as an example, this address has had financial transactions with blacklisted addresses.

Blacklisted addresses typically include mixer addresses and those marked for scams/phishing. If a project’s related addresses are involved with blacklisted addresses, users should be cautious in their interactions.

3. Follow Credible Resources and Latest Information

Check if the project has an audit report, whether the team is public, and if the project details are comprehensive. Follow community updates and social media trends to stay informed about the project’s reliability and security. A lack of transparency in a project is a red flag; investors should demand detailed information and ensure that the project team can provide clear answers.

4. Beware of Impersonating Popular Projects

Knockoff coins often attempt to associate themselves with popular projects on the market to catch investors’ attention. They may use similar names, logos, or slogans to create a false association with well-known projects. However, this association might be deceptive, and investors need to carefully verify the project’s authenticity.

5. Be Wary of Social Media Hype

Knockoff projects might conduct extensive promotions on social media platforms to create buzz and intrigue investors. However, investors should remain level-headed and not be fooled by hype, making decisions based on actual research and investigation.

In Conclusion

Scams are constantly evolving, so it’s crucial to be cautious and well-informed about project details. If unsure about a project or opportunity, it’s advisable to analyze the project and related addresses as mentioned above, understanding the risks thoroughly before participating cautiously.

Beosin currently employs technologies and analysis systems like EagleEye and KYT to conduct in-depth analysis and risk assessments of projects, allowing for early detection of potential or ongoing investment scams, providing timely warnings and advice. Additionally, Beosin collaborates with the crypto community, other security companies, and regulatory authorities worldwide to create a safer, more reliable environment for the Web3 ecosystem and to minimize the occurrence of such scams.

Related Project

Related Project Secure Score

Guess you like

Poloniex under Justin Sun Hacked for Over a Billion Dollars, Raft Project Loses $3.4 Million

November 14, 2023

Beosin Unveils New Blockchain Solution for Financial Regulation and Security at SFF

November 20, 2023

A Security Perspective on the GameFi Fren Pet Across the Entire Chain

November 23, 2023

Heco Bridge hacked over $83M and Kyber exploited over $48M. How should we be more vigilant after these two security incidents?

November 24, 2023