November 28, 2023

Unlicensed Exchanges Collapse - How Should Users Guard Against It?

Recently, according to reports from the media outlet "Hong Kong 01," as of November 25th, the fraudulent investment platform "Hounax" has deceived at least 131 people, with the police receiving 88 reports, involving a staggering amount of 110 million HKD.

Previously, the cryptocurrency exchange HOUNAX actively attracted users in Hong Kong, claiming to be co-founded by the original Coinbase technical team and holding an MSB business license in Canada. This is a significant fraudulent investment platform scam in Hong Kong following the JPEX exchange exit, further raising investor alertness to false platforms, especially after the JPEX incident.

The occurrence of the Hounax incident has once again shaken the Hong Kong Web3.0 investment market, especially following the JPEX exchange exit, increasing investors' vigilance towards false platforms.

These incidents remind us that investors must exercise high vigilance and conduct thorough due diligence and careful assessment before participating in any investment activities. Understanding the platform's background, regulatory status, and feedback from other users are crucial in avoiding becoming a victim.

Hounax Scam Tactics

An article by "Hong Kong 01" last week pointed out that one victim, who joined a stock market investment group on a social media platform at the end of August, was persuaded to invest in virtual currency through the "HOUNAX" application due to limited profits in stock trading.

One victim, Ms. Zhu, described that after investing over 2 million HKD, she saw returns exceeding 10 million HKD after some time. When she attempted to withdraw funds, she was informed that a 5% security deposit was required; otherwise, her account would be frozen with no chance of retrieving her funds. Many victims facing similar situations formed a "HOUNAX Victims Group" on Facebook

Victims posted an announcement ostensibly from "HOUNAX Global Digital Asset Trading Center Cryptocurrency Asia-Pacific Region (Singapore) Exchange," stating that illicit funds had entered some users' HOUNAX accounts, leading to the freezing of bank accounts for some investors.

Victims pointed out that in the WhatsApp investment group that initially persuaded them to download the HOUNAX application, many claimed successful withdrawals and even planned trips, property purchases, and extravagant spending. Victims stated that these were staged performances by individuals hired by the platform, not genuine users.

Another victim in a Facebook group stated that after depositing a security deposit, the platform demanded a 3% withdrawal fee, leaving him unable to pay this additional amount.

Since news about HOUNAX emerged on November 1st, all HOUNAX social platforms secretly deleted user comments, including on Facebook, X, and YouTube channels. Although most comments were removed, occasional real-time comments accusing the platform's credibility remained.

Several platforms listed as suspicious by the Hong Kong SFC

False investment scams are common financial crimes aimed at deceiving investors for improper gains.

Following the JPEX exchange, the Securities and Futures Commission (SFC) in Hong Kong listed HOUNAX as a "Suspicious Virtual Asset Trading Platform" on November 1st, warning the public to remain vigilant about the platform's legitimacy and security, similar to the previous JPEX incident.

The list of unlicensed companies and suspicious websites includes companies that have not obtained a license in Hong Kong and have attracted the attention of the SFC. These companies are suspected of currently or previously targeting Hong Kong investors or claiming to have a connection with Hong Kong.

These platforms typically use high returns and low-risk investment opportunities as bait to attract investors. However, once investors entrust funds to false platforms, they often encounter problems such as inability to withdraw funds, account freezes, or false trading records, resulting in financial losses.

SafeTrade Suspected of a"Rug Pull"

Recently, SafeTrade Exchange is suspected of executing a "rug pull," leaving users equally defenseless and caught off guard.

On November 22, a KOL tweeted that SafeTrade only allowed users to deposit funds but not to withdraw them. Users had previously raised issues about deposits not being credited.

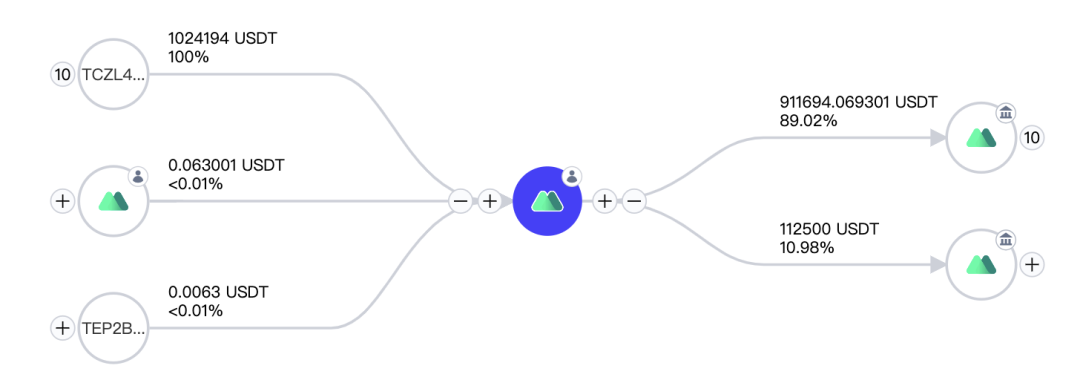

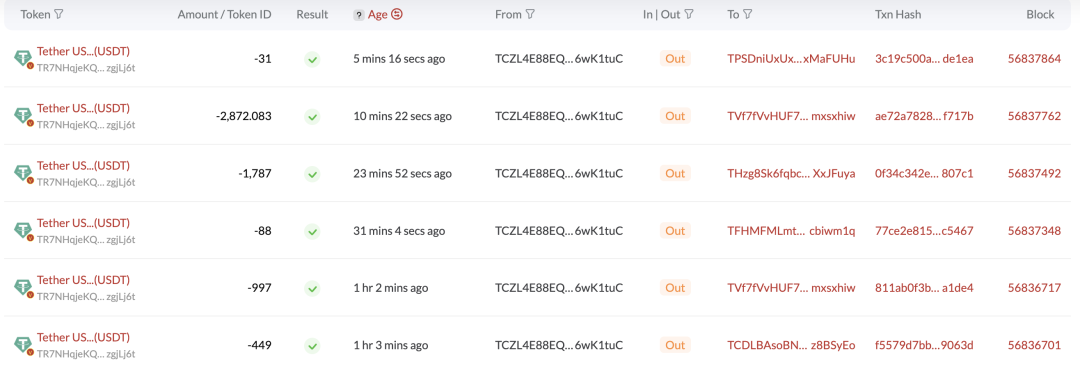

Based on user-provided information and analysis from the Beosin KYT anti-money laundering analysis platform, the relevant addresses are identified as follows:

SafeTrade USDT (TRC20) hot wallet address:

TCZL4E88EQ4eqUNpTpwERcHwA1N6wK1tuC

SafeTrade Mexc USDT (TRC20) deposit address:

TWDVchAir1nUo9cWZqPa3udyQMDrGfCs9o

On November 23, SafeTrade transferred 1.02 million USDT from its hot wallet address TCZL4E88EQ4eqUNpTpwERcHwA1N6wK1tuC to its Mexc accounts (TEPSrSYPDSQ7yXpMFPq91Fb1QEWpMkRGfn and TB37WWozkkenGVYWD7Do2N5WT2CedqDktJ), and its exchange USDT withdrawal service was suspended. Subsequently, SafeTrade resumed USDT withdrawal services, with only 38,000 USDT remaining in its hot wallet account, and users are currently attempting to withdraw funds:

link: https://tronscan.org/#/address/TCZL4E88EQ4eqUNpTpwERcHwA1N6wK1tuC/transfers

Therefore, we recommend that users withdraw funds as soon as possible to avoid withdrawal failures after SafeTrade's hot wallet funds are depleted.

Unlicensed exchanges collapse - How should users guard against it?

Here are some suggestions regarding fraudulent investment platform scams to help users enhance security:

1. Be cautious in choosing investment platforms: Exercise extra caution when selecting investment platforms, opting for regulated and reputable platforms. Conduct thorough research, checking the platform's registration information, regulatory licenses, and user reviews. Also, pay attention to the exchange's reserve fund proof.

2. Be wary of high return promises: Be vigilant about investment projects claiming to provide exceptionally high returns. If a project promises returns that are too exaggerated or unreasonable, there may be fraud risks. Reasonable investment returns usually come with corresponding risks.

3. Pay attention to investment risk education: Understand the risks and potential issues of investments, practicing appropriate risk management. Avoid trusting so-called "zero-risk" investments, maintain the right investment mindset, and avoid blindly following trends or impulsive investments.

4. Confirm platform compliance: Verify if the investment platform is regulated by relevant regulatory authorities, such as securities regulatory agencies or financial regulatory authorities. Compliant platforms usually disclose relevant information and adhere to regulations.

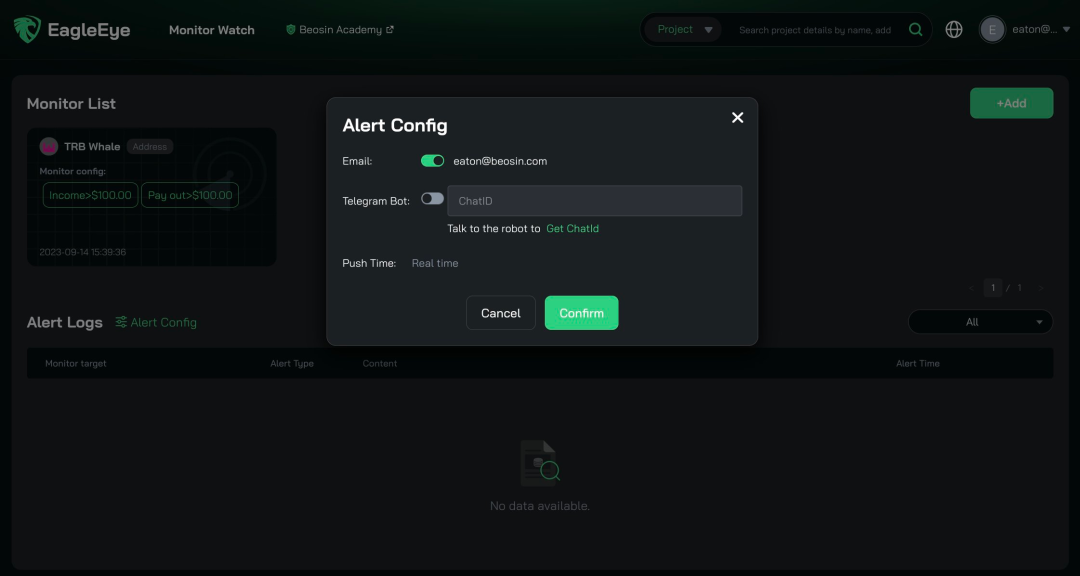

5. Protect personal information and fund security: When using investment platforms, pay attention to protecting personal information and fund security. Avoid making investment transactions in untrusted network environments and ensure the use of a secure network connection. Monitor and set alerts for exchange addresses.

6. Monitor exchange addresses with alerts: Legitimate exchanges disclose their hot wallet addresses. Users can use trusted third-party platforms to monitor and set real-time alerts for their wallet addresses. The EagleEye platform launched by Beosin provides real-time alerts and monitoring, allowing users to set criteria for monitoring wallet address activities, such as setting alerts when funds outflow exceeds a certain amount.

7. Be cautious about investment advice and promotions: Exercise caution with investment advice and promotions from strangers or unverified sources. Do not succumb to high-pressure sales or influences pushing investment decisions. Conduct independent research and judgment, avoiding blind trust in others' promises.

8. Report promptly and seek legal assistance: If you discover yourself falling victim to investment fraud, immediately report it to the police and seek legal assistance. Taking prompt action can increase the likelihood of recovering losses.

Remaining vigilant, enhancing investment knowledge, choosing compliant investment platforms, and adopting appropriate security measures are crucial in preventing fraudulent investment platform scams. Prudent decision-making and risk management are essential aspects of the investment process, ensuring the safety of your investments and personal financial security.

Additionally, such incidents call for regulatory bodies and law enforcement to implement stricter regulatory measures, ensuring the healthy development of financial markets and the protection of investors. Strengthening monitoring and crackdowns on fraudulent investment platforms and increasing penalties for non-compliant platforms can help reduce the frequency of similar scams, maintaining the interests of investors and market stability.

Beosin previously launched a comprehensive "one-stop" Web3 security and compliance solution for Hong Kong Virtual Asset Service Providers (VASPs) and Web3 applications. This solution includes KYT/AML technology, smart contract security audits, virtual asset compliance due diligence, virtual asset security monitoring and alerts, and exchange security solutions. Through Beosin's efforts and innovation, we hope to see more reliable and secure technical support in the development of the digital economy, paving the way for the prosperity of the Hong Kong Web3.0 era.

Contact

If you need any blockchain security services, welcome to contact us:

Related Project

Related Project Secure Score

Guess you like

Understanding the RGB Protocol: Bridging Bitcoin and Smart Contract

November 24, 2023

Unlocking Web3 Business Insights and Risks: The Power of Beosin API Features!

November 30, 2023

Blockchain Security Recap of November: $356.53M Lost in Attacks

December 01, 2023

BTC Potential| Exploring Key Protocols in Enhancing BTC Scalability

December 05, 2023